michigan property tax formula

Counties in Michigan collect an average of 162 of a propertys assesed fair. Michigans Property Tax Act Act 206 1893.

Property Taxes By County Interactive Map Tax Foundation

The state charges 375 for each increment and the county charges 55 which an be up to 75 as authorized by the.

. The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000. The Great Lake State is a high-tax state. So if your home is worth 200000 and your property tax rate is 4 youll pay about.

Ingham County contains most of the state capital Lansing and has one of the highest property tax rates in the state of Michigan. The Michigan Homestead Tax Credit gives some Michigan residents a refund on the amount of property taxes they owe or the amount of property taxes their landlord owes. The Millage Rate database and.

Homeowners pay an average of 161 of their home value in property taxes or 1611 for every 1000 in home value. The average effective rate including all parts of the county. 2112 et seq provides specific instructions on how to prorate taxes at a closing when no proration agreement exists between the buyer and.

145 average effective rate. On the other hand Michigan homeowners are protected from. The Michigan Treasury Property Tax Estimator page will experience possible downtime on Thursday from 3PM to 4PM due to scheduled maintenance.

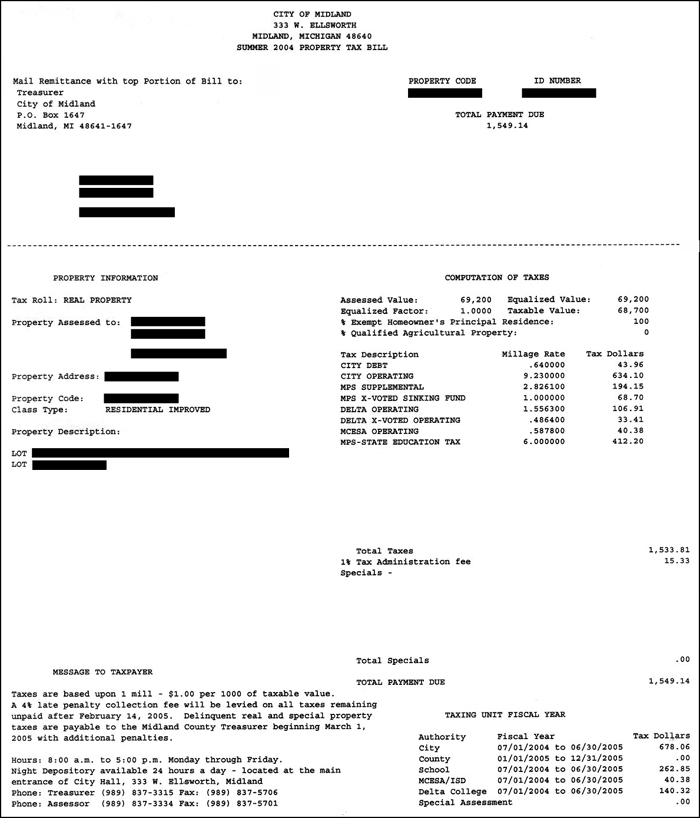

The average tax rate in the state is 1632 percent and the average property tax invoice is a cool 4080 in 2019. Simply enter the SEV for future owners or the Taxable Value. A Michigan property tax bill consists of three basic parts.

Michigan State Tax Quick Facts. You can now access estimates on property taxes by local unit and school district using 2020 millage rates. Taxes in Michigan.

To estimate your real estate taxes you merely multiply your homes assessed value by the levy. Computing real estate transfer tax is done in increments of 500. The inflation rate adjustment for this years property taxes in Michigan is 33 less than a maximum 5 allowed under Proposal A but it is the highest it has been in about 15.

A series of individual ad valorem tax levies fixed dollar levies called special assessments an optional collection fee.

What Do Property Taxes Pay For Where Do My Taxes Go Guaranteed Rate

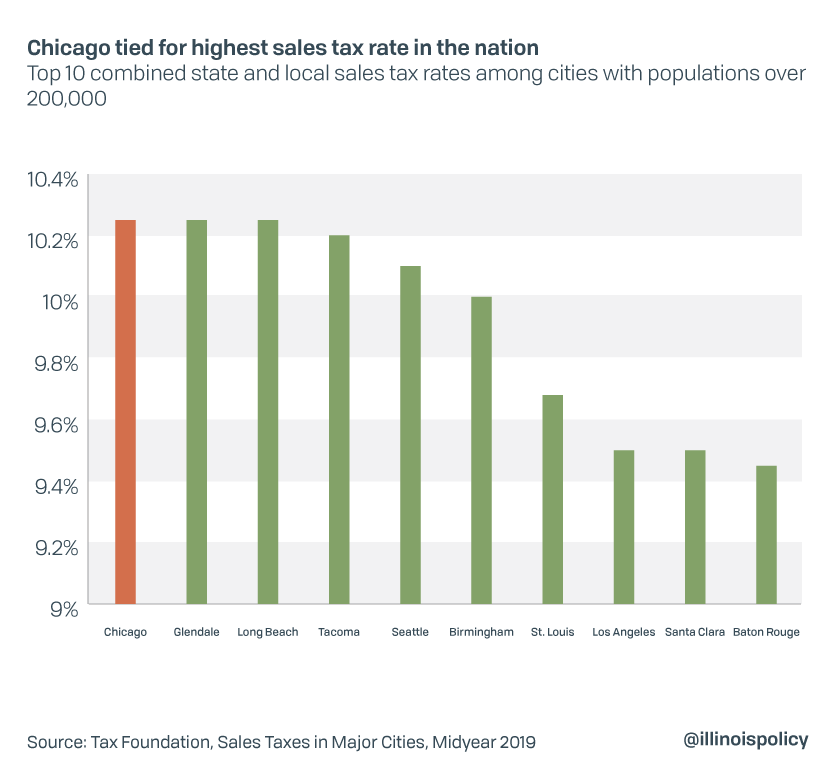

Chicago Defends Title Of Highest Sales Tax Rate In The Nation

Why Property Taxes Go Up After Buying A Home In Michigan

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Tax Cuts Are Coming But Michigan Is Already A Low Tax State Citizens Research Council Of Michigan

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Michigan Property Tax Calculator Smartasset

The Ultimate Guide To Michigan Property Tax Easyknock

Michigan Sev Values Tax Burdens And Other Charts Maps And Statistics

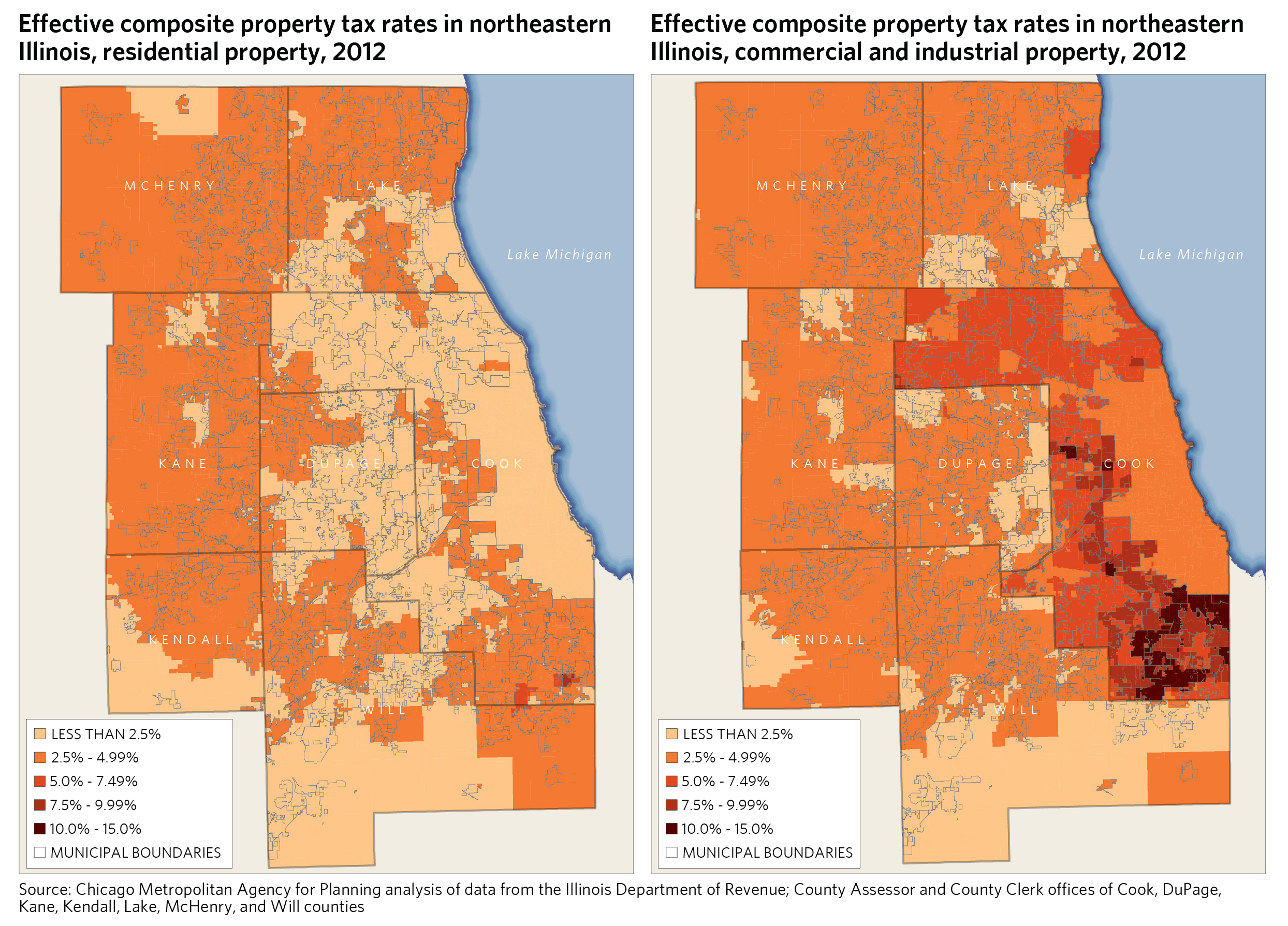

Cook County Property Tax Classification Effects On Property Tax Burden Cmap

U S Cities With The Highest Property Taxes

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/19631901/Screen_Shot_2020_01_27_at_10.12.12_AM.png)

How To Read And Appeal Your Detroit Property Tax Assessment Curbed Detroit

Calculation Of An Individual Tax Bill A Michigan School Money Primer Mackinac Center

Property Tax Calculator Smartasset

Taxes Pittsfield Charter Township Mi Official Website

Property Taxes By County Interactive Map Tax Foundation

Michigan S Property Tax Burden And How It Has Changed Over Time Citizens Research Council Of Michigan